News

Public Crypto Funds See $61M Inflow as Bitcoin ETF Hopes Mount

Publicly traded cryptocurrency funds experienced a significant influx of new capital on Monday, totaling over $61 million. This influx represents about 10% of the total net deposits into such funds for the entire year so far.

The majority of the new assets, around $57 million, went into Bitcoin investments. This comes as Bitcoin briefly surpassed $35,000 for the first time since May 2022, likely fueled by rising anticipation of a spot Bitcoin ETF being approved in the US.

ETC Group in Germany saw $24.3 million in inflows, while Canada's Purpose Investments took in $10.9 million. Switzerland's 21Shares AG also received approximately $11.8 million.

Excitement is building after BlackRock's proposed Bitcoin ETF was listed on the DTCC and a court directed the SEC to reexamine Grayscale's ETF application. With heavyweight firms competing for the first approval, the long-awaited crypto fund could become a reality.

The surge into publicly traded crypto funds highlights acute investor demand for regulated Bitcoin exposure. If the SEC grants even one spot ETF, it could unleash a flood of institutional capital into the crypto markets.

Recommended to read

Juan Soto: Pursuing Record-Breaking $500M+ Free-Agent Deal Beyond Ohtani's

Juan Soto's bold decision to reject a $440 million contract offer from the Washington Nationals and his potential to secure a groundbreaking deal surp...

Read more

Devils Crossroad by Nolimit City

Devils Crossroad, developed by Nolimit City, is a thrilling slot game that takes players on a captivating journey into the dark underworld.

Read more

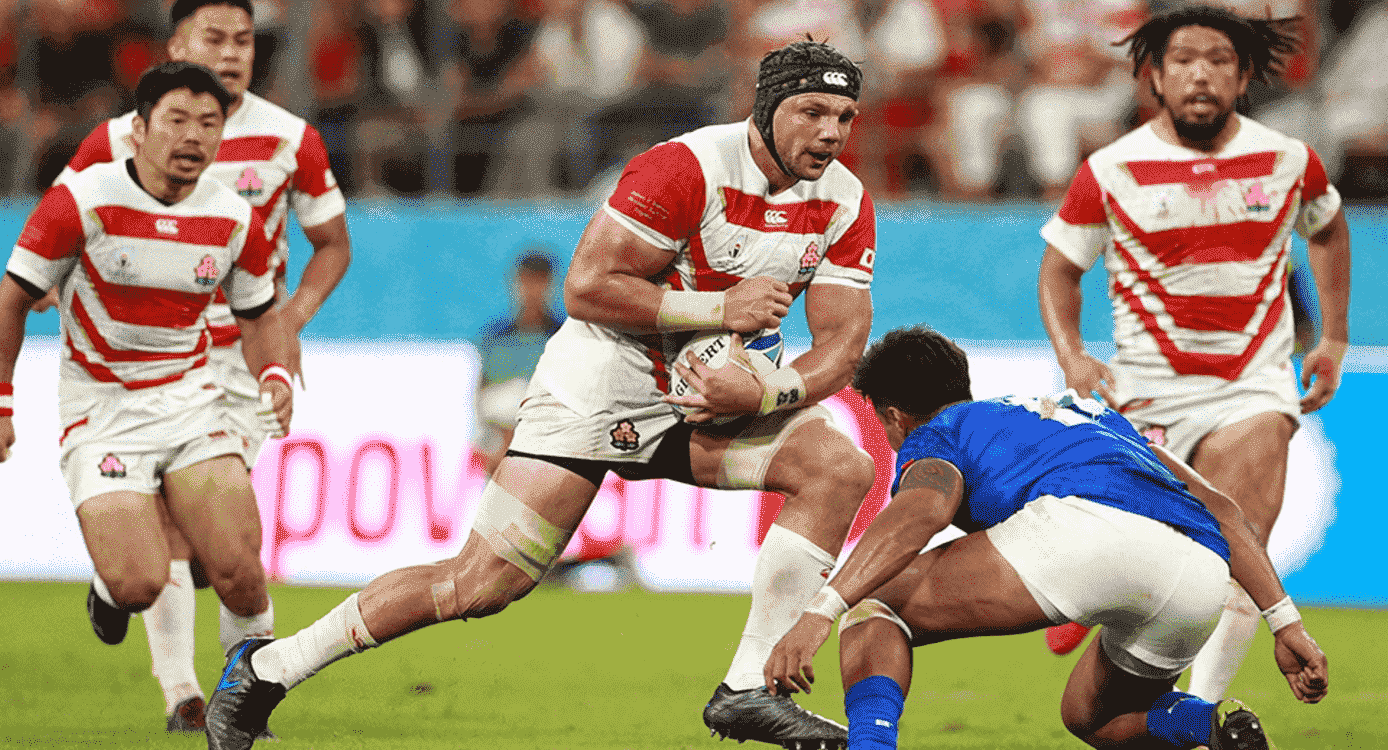

Japan Holds Firm Against Samoa Comeback, Securing England's Quarter-Final Spot

In a closely contested match in World Cup Pool D, Japan secured a narrow 28-22 victory over Samoa, edging closer to the quarter-finals along with grou...

Read more

Get K8 Airdrop update!

Join our subscribers list to get latest news and updates about our promos delivered directly to your inbox.